Business Insurance in and around Paso Robles

One of the top small business insurance companies in Paso Robles, and beyond.

Helping insure businesses can be the neighborly thing to do

Cost Effective Insurance For Your Business.

The unexpected happens. It's always better to be prepared for the unfortunate problem, like an employee getting injured on your business's property.

One of the top small business insurance companies in Paso Robles, and beyond.

Helping insure businesses can be the neighborly thing to do

Get Down To Business With State Farm

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like extra liability or worker's compensation for your employees, that can be molded to develop a customized policy to fit your small business's needs. And when the unexpected does happen, agent Steve Weber can also help you file your claim.

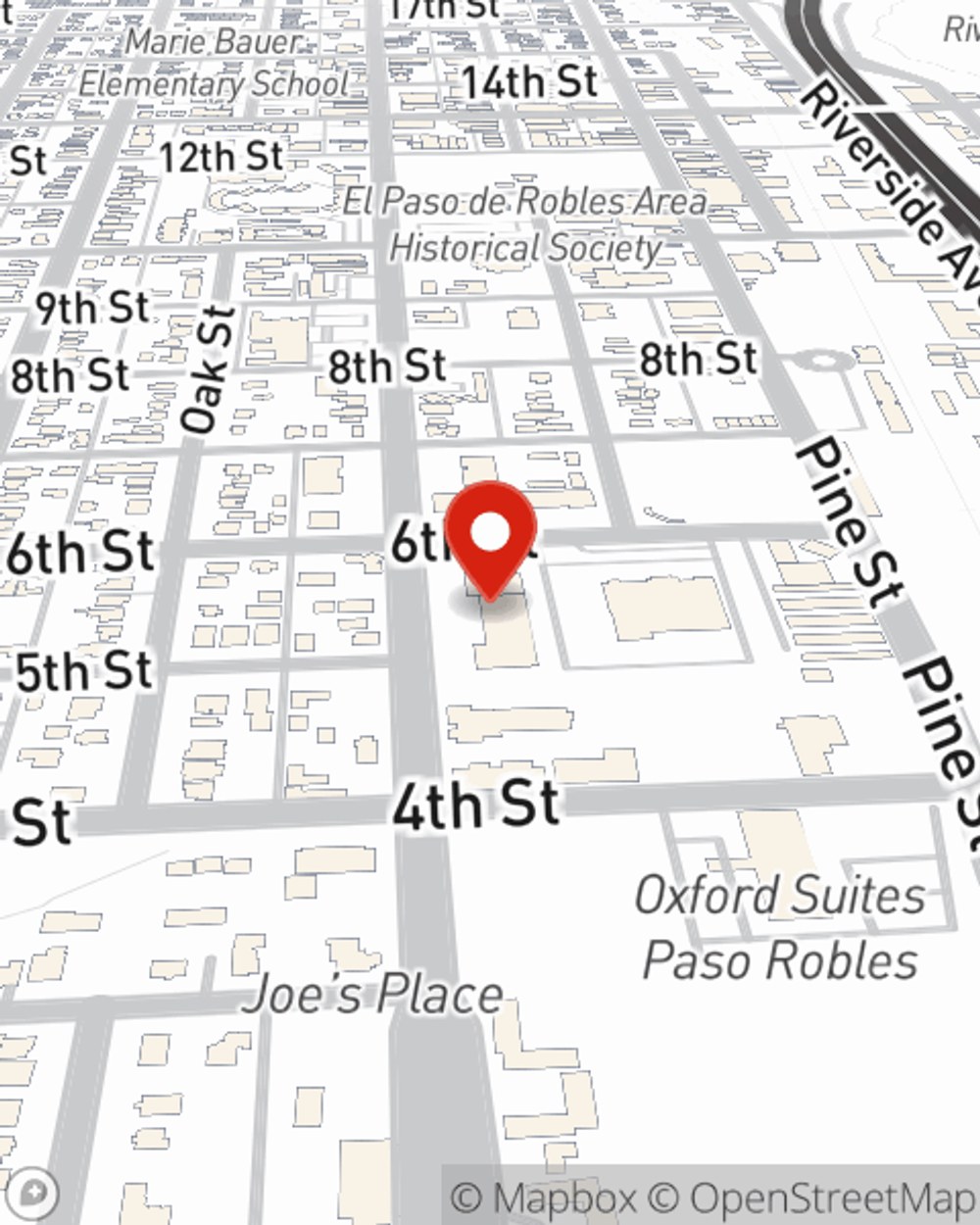

Intrigued enough to investigate the specific options that may be right for you and your small business? Simply visit State Farm agent Steve Weber today!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Steve Weber

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.